Martin Wolf, chief economist of the “Financial Times”, proposes radical reform for the financial system, speaks out against German austerity politics and the biggest mistake of all: the Euro.

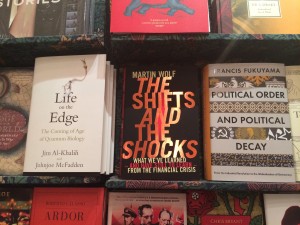

The high towers of London’s City look small from the 33rd floor of the newest skyscraper, the Shard. Everything is relative – even the size of the financial district in the British capital. Martin Wolf, columnist of the “Financial Times”, meets profil for a Lunch with the FT in the Chinese Restaurant Hutong high up over the river Themse. The pope of English speaking economic journalism just published his new book “The shifts and the shocks”. He calls for radical reforms of the financial system, which so far has not been adjusted to the consequences of the financial crisis and to the 21st century.

Wolf’s father Edmund was from Vienna. A playwright and journalist who chose not to return to Vienna after visiting London in 1938. His son Martin, 68, became one of the most influential economists of the Western world. Martin Wolf is also a great aficionado. He enjoys eating and speaking. He attacks a Peking duck in the same way as those who fail to reform the financial system: with ruthless precision.

Profil: We are sitting on the 33rd floor of London’s new skyscraper Shard and the City of London lies in front of us – the financial heart of Europe if not the Western World. Is it a healthy organ?

Wolf: Let us assume the world stays more or less as it is now with open capital markets, so people can export around the world. The city will stay more or less what it is, there are massive assets to be traded in it. Therefore in that sort of world nothing is going to displace London. In this world there will be three relevant time zones: East Asia – possibly later South-East Asia - Europe and America. In each time zone you need a dominant centre, and this will be London. There is no rival to London.

Profil: Maybe Frankfurt and Geneva?

Wolf: If the British go crazy and we leave the EU – well, let’s leave this for later, when we get to the disaster scenarios. But in terms of cities: Frankfurt and Geneva are just too small. There are more people employed in the city of London alone than the entire population of Frankfurt has. The only city that has the scale to replace London is Paris and the French simply do not have any of the other necessary things, which would make a financial centre work. In a different world – if Germany would not have been divided in the way it was. Berlin is big enough to be a financial centre but it is not even the financial centre of Germany. To be a world class financial centre nowadays you need a large population, you need English as your main language and you basically need English law. Which is why Hongkong and Singapore are the main rivals in the east.

Profil: How about Shanghai?

Wolf: It might be that in the long run Shanghai could replace them. It is conceivable that they will create a Chinese language alternative to English speaking Hongkong because China is big enough to shift the whole balance of the world. Nothing is forever, also not the English dominance of the financial world. So far China still lacks a few things: It does not have a rule of law. Most of its people want to get their money out if they possibly can to...

Profil: ….London…Before we come to the disaster scenarios –

Why did the US get through the crisis seemingly better than Europe?

Wolf: Three differences. First, I think that the underlying dynamic of the US economy has been for a long time stronger than Europe’s. There is more innovation going on in the US. There is a stronger forward going dynamic in the US than in Europe as a whole. That helped to go through the crisis. It is easier to manage debt in a growing economy than in a stagnant economy. Since the crisis the US economy has grown roughly 10 percent in comparison to the European economy. This is quite a big difference. The second difference is obvious and banal. The US is a functioning federal system. It is not a perfect federal system, it has lots of problems, but it has a federal government. And the federal government was able to act, decisively, able and ruthlessly, really ruthlessly. And nobody could question it. When Florida had a deep housing crisis there was never any question that the government of Florida would have to rescue its bank through the federal system because they have a federal banking structure. When Spain fell into crisis it was the Spanish government who had to solve it alone because the EU has no federal government and no Fed to help. By the summer of 2009 the US had dealt with its banking crisis. The EU is only beginning to take measures the US used 6 years ago. The third reason is that between fiscal and monetary policy the American central bank took it for granted that it was its job to ensure enough demand to generate and support domestic growth. They did not rely on foreign demand, they relied on their own. The Germans define the role of the European Central Bank differently.

Profil: Why should the EU not follow the German ideas? Their economy has been more successful than any other in Europe.

Wolf: The German program does not make sense for the Euro zone because it is a program for a small open economy. It does not make sense for a large closed economy. The Euro zone is three times bigger than Germany. It is a really big economy. Germany on its own is just a middle sized economy with a very strong export sector. Germany’s balanced its low domestic demand and its high labour costs with their exports – mainly to China. This is the competence of Germany - and to some extent of Austria: manufacturing. Nobody produces on such a level. It was build up over 150 years. So Germany was able to shift. Meanwhile the rest of the Euro zone was basically pushed into austerity and the economies declined and never really recovered. The Euro zone has no demand at all. So the German model is no good for most of the other Euro zone states. And if you do it, then it comes at a price. You see all the populist xenophobic parties popping up all over the Euro zone.

Profil: Not only the Euro zone, here in Great Britian UKIP, a populist xenophobe party is currently extremely successful.

Wolf: I am not going to defend UKIP, God knows I oppose them. But they are not racist in the traditional sense as they are against white European immigrants, not against coloured people from Pakistan. The people from our former empire are by far the largest group among the immigrants. They just don’t want any more newcomers. It is clearly true that in parts of the country the inflow has been enormous. So it is not necessary racist. But it is xenophobic for sure. The society has become more unequal.

Profil: So do you agree with Thomas Piketty, a French colleague of yours as economist, who thinks inequality is one of the decisive factors for instability in the world and which we need to fix first and foremost. And that inherited capital grows faster than earned money and should therefore be taxed higher?

Wolf: I am not clear if this is true. His “r exceeds g” formula is quite right. But there are special factors there. The enormous rise in land prices is a big factor. Next to the inequality of wealth we should also consider the inequality of income. In any case I think it is a very important book and I reviewed it and I admire it.

Profil: After the FT attacked Piketty for being wrong your newspaper in the end gave him the “best book of the year 2014” award.

Wolf: Well, we are a broad church, we have different priests. We have no party line. And the journalist in question did quite good work.

Profil: What effect has inequality on the economic situation?

Wolf: It affects demand. It is one of the reasons why credit growth is so weak. It effects politics. It makes our politics more plutocratic. But plutocracy can get to a point where a democratic system ceases to function. Through wealth and inheritance taxes we need to attempt to achieve a greater degree of equality than we have now.

Profil: Is it all the fault of the Euro?

Wolf: It was stupid to implement a common currency without a Political Union. As I always said: the Germans understood this. They were the only ones who fully understood that a monetary Union can not fully work without a political union. The mistake was largely made by the French. Also by the Spanish and Italians because they have never thought it through.

Profil: What do you think the Western world must do to prevent another financial crisis from happening?

Wolf: You cannot do comprehensive financial reform in the middle of the crisis. So we have to do this afterwards. The most important thing to my mind has always been some structures of fiscal solidarity of which shared bonds is a crucial part. You can’t have a banking union without Euro bonds. I know it is not conceivable now but in the long run I think it is inevitable. The debt of one country has to be shared if it is to be a genuine federation. And in the end, if the Euro zone is to survive, it has to become not a federation like the US today, but at least a confederation like Switzerland. Even Switzerland which is a pretty loose confederation has a shared debt and monetary system and a federal treasury. There has to be one for Europe, too. A small one, but there has to be one. Once you have a common treasury and Euro bonds and Germany will accept that sometimes inflation will be higher than they would wish for – because they are in a federal system – then it could work. Of course this implies a move towards stronger political institutions.

Profil: Can this be done?

Wolf: I have no idea.

Profil: So far Germany does not want to pay the debt of the Southern member states. Berlin does not want a common European debt regime.

Wolf: If Germany does not want the sort of Euro zone which I just described - the only workable Euro zone with a federal policy designed to achieve an adequate demand for the whole zone - then Germany should leave the Euro zone.

Profil: Are you seriously thinking Germany will drop the Euro?

Wolf: I don’t think they ever will because they have a very good deal here. They would have real problems if they left, it would be very bad for German exports. It would be logical if Germany left and it would make life much easier for everyone else. I am NOT recommending this, it would be a terrible political disaster. But the least bad way of fixing it if it cannot be fixed internally, would be that Germany leaves the Euro zone. And Austria will leave with it.

Profil: The new EU commission president Jean-Claude Juncker proposed a new economic investment plan. Is this a game changer?

Wolf. Good idea, far too small.

Profil: Will it work?

Wolf: No. If you work through the numbers for fresh spending it is not big enough. The minimum in my judgement what the Euro zone needs to get demand growth is three times as much. This program does not come close to it in terms of fresh money. So, it is the right direction but the sums are too small. Juncker's advisers are perfectly sensible people, they know with what he could get away with when talking to the member states.

Profil: Apropos member states: Is it likely that the UK will leave the EU by 2017?

Wolf: Believe it or not in 1997 I argued that Britain should join the Euro. I argued that for about 6 months. It is well known. I wrote three columns about it, they were quite important. My basic argument was, and it turned out they were utterly correct: If the Euro went ahead then sooner or later if it were to work the euro zone must form a more integrated political identity. This zone would be a shell structure. The decision would be taken by the Euro zone because they were the overwhelming majority of members. And Britain’s role would be completely marginal, we would become, as I put it then, semi-detached now and fully detached in the end. If the Euro would be a success the EU as we know it now would cease to exist. I said: The UK as a large country with a desire to influence Europe and not just as an outsider forever should join the Euro and make sure that as it evolves we check how it develops. If we would have been in then for sure it would not have followed its present policies. There is no doubt that Germany can resist France and Italy but it could not have resisted France, Italy and Britain. A year later I finally decided that the British people were just not ready for it.

Profil: Not only that – it seems David Cameron is steering the UK close to an Exit from the EU altogether.

Wolf: The conservative party for reasons which are partly internal and partly external has become more xenophobic and anti-EU, the Euro zone has gone to somewhere else, so my view that we should wait and see has been taken over by events. It is quite possible that we will not wait and leave. We are an island. We have been an off-shore island before and maybe we are doomed to be an off shore island again.

Profil: What are the chances?

Wolf: If we are betting on it, the chances of us leaving in the next parliament is about 50:50.

Profil: That high? Cameron cannot hold back the forces anymore or does he himself want to leave?

Wolf: If Cameron is prime minister his party will split. He won’t get a good deal from Europe. So he might well argue for leaving. The xenophobia has become significant here. It has mostly to do with immigration. But it is there. That was an unexpected side effect of being in the EU which I had not expected: the scale of immigration. In a referendum Labour, LibDems and SNP will argue for staying in. Tories and UKIP will argue for going out. It is very, very risky. Meanwhile these negotiations could go to hell. They could be very difficult. Because the Euro zone members will rightly say: Who the hell wants to negotiate this nonsense with you? And I am completely with the rest of the EU on this.

Profil: Would it be better for the UK to stay in the EU?

Wolf: Of course this is one of the debates. It partly depends on what the alternatives would be. I had once a debate with the treasurer of UKIP. And he said it was so important to leave the EU. And I asked: Tell me what you mean by leaving the EU. I can think of 5 different alternatives. It depends on negotiations. Cameron is gambling in the hope to keep his party together. This party in its very long history have split before. The Tories have split over free trade in the 1840ties. They split over imperial preference and trade in the early 20th century. And they are splitting over Europe. So David Cameron is a party manager first.

Profil: Could he have stayed clear from getting deeper and deeper into right populist waters?

Wolf: I am opposed to his policies. I think they are a mistake for the country. And I think they have not worked for his own party either. Because every time he gives the skeptics what they want they ask for more. The skeptics can never be satisfied. They just want to leave the EU. So my feeling is that his tactics are not successful.

Profil: In your new book “The shifts and the shocks” you propose quite radial reforms to fix our financial system

Wolf: I have three different proposals of ascending radicalism to fix the financial world. The first one is already happening. We need to impose legal separation between retail banking and investment banking. No government will allow banks to default on deposits, including deposits bigger than the insured limit. Separate those from trading activities. The more radical proposal is much higher capital requirements. The true loss baring capacity without any question is common equity of the major banks in Britain is 4 percent of the balance sheet. And that in my view is far too small. It is 10 percent and possibly more. And then I call for 100 percent re-nationalization and to deprive financial institutions of the power to create money. If you want it to fund it in other ways than there would have to be time limits on how quickly the money can be withdrawn. And the value of the money you withdrew would depend on the value of the money on a day to day basis. This would clearly shift risks outside the banking sectors. My proposal has immense elegance and power. If the present system breaks down completely then people might think about it. Currently I am trying to encourage small countries to implement it. Like Iceland. I think it could work rather well.

Profil: It sounds as if you are experiencing a new Keynesian moment?

Profil: I always was a Keynesian. All British economists of my generation started off like this. After the Seventies I realized that we no longer lived in a world in which the Keynesians were relevant. But since the beginning of the 2000ands we are back in this world. The modern financial sector is much too unstable. In a severe crisis it is the job of the state to act. The state is the ultimate insurance organization in a society.

Profil: We almost forgot your disaster scenario! How does it look like?

Wolf: At the moment we have very low inflation in Germany. The chronic slump means inflation has fallen towards deflation, real debt is rising in many of these countries. And that will get worse. The problems of adjusting competitiveness within the Euro zone with such a low interest rate means that everyone has to have negative inflation which makes the debt problems worse. If Germany has one percent, the others have to have minus one or two percent. And then their debt gets bigger and bigger. And I am concerned that if the slumps continue that we will get elected in Greece, Italy, Spain and quite possibly France radical right or left people who will no longer stick with the program. If they don’t stick with the program you are going to have debt crisis. And public debt crisis means that the ECB will not be able to help them because it will not be consistent with the outright monetary transactions program. You will then have defaults, the banking sectors will go down and what then happens the Euro is in serious trouble.

Profil: Thank you for this doom scenario. Do you maybe have any positive scenario?

Wolf: Positive scenario? Yes. But I am getting more and more depressed about it. If M. Hollande were not as hopeless as he is and he is truly, truly hopeless – then a sensible scenario would start by agreement by head of government level and it would have to be worked out between Germany, France and Italy. We will allow fiscal policy across the Union for the next 3 or 4 years. We will allow the ECB - effectively not legally - to monetarize it in return for a clear radical reform program in France and Italy. It would be established, agreed and identifiable. This would be the basis agreed as a wider package for the Euro zone. I have spoken to senior ministers in these governments who recognized that this is necessary. Interestingly there are some German politicians mostly on the SPD side who would agree with me. This is the optimistic scenario.

Interview by Georg Hoffmann-Ostenhof and Tessa Szyszkowitz, Photos by Alex Schlacher